You may just need to trade some of those net worth assets for some cash flow. If this sounds like you, the answer to creating a better lifestyle for yourself might be sitting right in front of your nose. These same people often have a significant amount of stocks, bonds, and mutual funds that don’t pay them-just like owning a company that makes no profits. It’s just that I often hear people complain about not having enough “passive income“ to decompress their lifestyles. That’s not to say that there is no value in holding assets that don’t cash flow. Maybe it’s time for you to trade some of those assets in for income. That is-you own something that has a value but it doesn’t help you pay the bills. For starters it will clearly be skewed for anyone just entering the workforce as the first 16-22 years of life are typically spent with little to no income but those years are still used to. It has a value like any small business that you might own.īut, unless you have some dividend paying stocks, you’re doing the same thing as those net worth millionaires I’m talking about, right? I'm not familiar with the content of the Millionaire Next Door, but mathematically that formula is a poor approximation of what your net worth 'should be'. When you own a stock you on a fraction of a company. Well… do you own stocks? Are you getting much cash flow from them? Don’t you think it might make sense to trade in some of those assets for cash flow?Īfter all, it might make a lot of sense to have some of those investments throwing off money that you can actually use to pay the bills!īut wait a second…is it possible that you might be guilty of something similar to these net worth millionaires? Now you might be wondering what’s the point of being a net worth millionaire if you can’t pay your bills? I own one of those businesses RIGHT NOW!!! (Uggh)Īlthough these scenarios might sound ludicrous to you, they happen all the time. You could even own a huge business with millions of dollars of revenue but no profit. However, if your rents don’t exceed your expenses, there is no cash to pay your own bills. You might even own a great big apartment building and have millions of dollars of equity. You could sell your gold but that might take a little time. However, you might not have enough cash coming in on a monthly basis to pay your bills.

If you own a million dollars worth of gold, you are a millionaire. It just means that you own stuff that has a value that could be redeemed upon sale. What does it mean to be a millionaire anyway? It means that on your personal financial statement, your assets exceed your liabilities by $1 million or more.ĭoes that mean you have $1 million of cash sitting there? Probably not. I’m talking about not being able to cover the mortgage on their home or even the electrical bill. No, I’m not talking about the pain on not being able to buy a yacht.

#THE MILLIONAIRE NEXT DOOR FORMULA HOW TO#

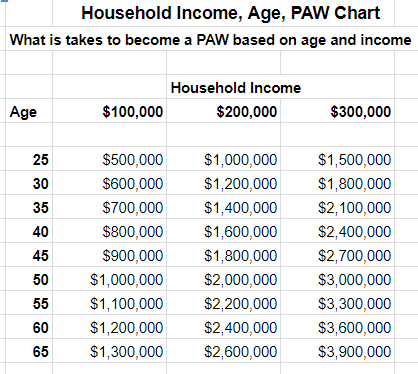

The book also tells of how to determine your wealth, a very neat formula. This may sound crazy but I know a lot of high net worth people (greater than $10 million) who get into cash crunches all the time. Millionaire Next Door Written by: Thomas J.

0 kommentar(er)

0 kommentar(er)